THE

FUND

Realvest Capital is a real estate equity fund focused on Central Europe (mainly Poland). Major areas include commercial & logistic real estate, mixed use and premium residential houses. It will also invest in land development, condo hotels and opportunistic real estate transactions.

Our fund invests in real estate platforms and projects in their early stage. Our targets are both pre-development and development stage real estate projects. Our main purpose is to create value through appropriate legal procedures, unique solutions, proper planning and design. The combination of all these approaches results in the creation of premium projects that add value above and beyond the common market.

Square Meters

PLN market value

OUR

TEAM

FUND

CHARACTERISTICS

FUND SIZE

€ 100 – 300 m

ASSETS

Condo hotels, commercial real estate, logistic centres, mixed use real estate, land development, premium housing real estate.

TYPE OF OFFER

| Private Offer |

| Share Class A to be subscribed by the project sponsors with a minimum of €1,000,000 |

| Share Class B meant for professional or qualified investors with a minimum subscription of €100,000 |

| Share Class C, meant for investors who would subscribe at least €1.000,000 |

EXPECTED RETURN ON EXIT (SHARE CLASS B & C)

> 10 % annually (at the end of the Fund duration)

TRACK RECORD

EXPERIENCE

Our specialists have vast experience in the creation of real estate portfolios gained at recognized investment and development companies on both the Polish and international property markets. Over the years, they have been involved in the creation of profitable real estate portfolios consisting of modern residential buildings, class A office and retail space, as well as other commercial spaces such as hotels, senior housing and logistics facilities. They cooperate with the leading architects of the hotel and housing estate industry, the largest sales offices specializing in the premium segment and international hotel chains.

Our team manages real estate portfolios with a total area of more than 500 thousand SQ M of buildings, 1 MLN SQ M of land and a market value exceeding 6 BLN PLN, 50% of which are properties located in Warsaw and the Warsaw agglomeration.

discover our signature investments

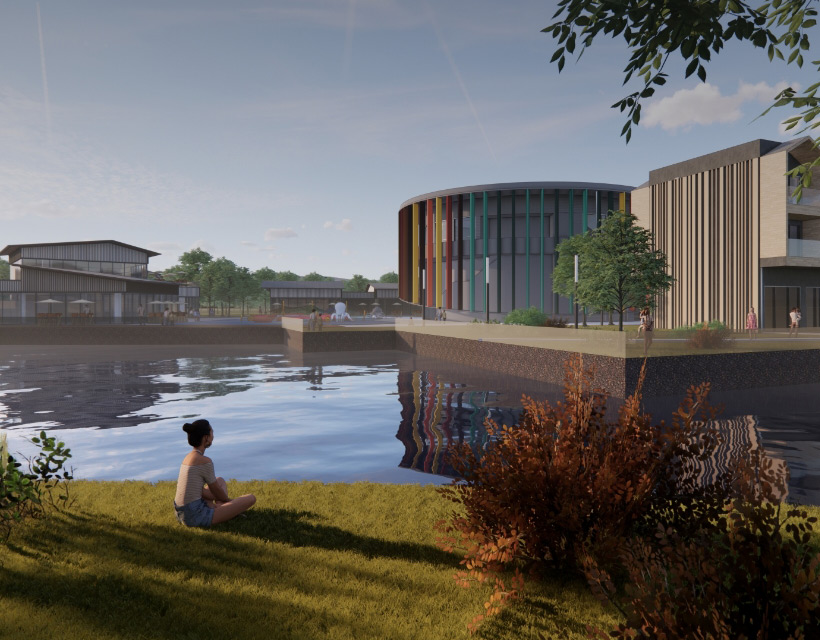

new age residential estate

Investment size: 50 mln PLN netto

Hôtels & Préférence Szklarska

Investment size:

STAGE I - 150 mln PLN netto

STAGE II - 32 mln PLN netto

TOTAL: 182 mln PLN netto

Senior Care Center in Habdzin

Investment size: 35 mln PLN netto

Głogowska Dormitories

Investment size: 75 mln PLN netto

VILLAS PRZESMYCKIEGO

Investment size: 50 mln PLN netto

HOTEL INDIGO

Investment size: approx 50 mln PLN netto

Ready to buy

INVESTMENT STRATEGY

best offers

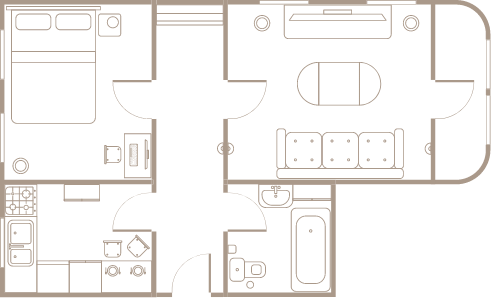

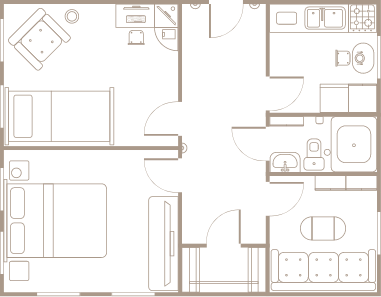

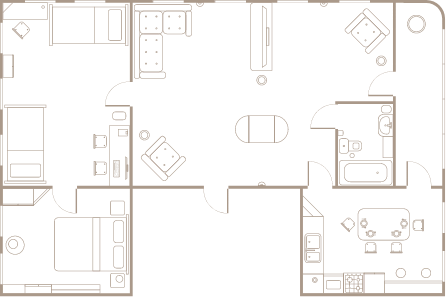

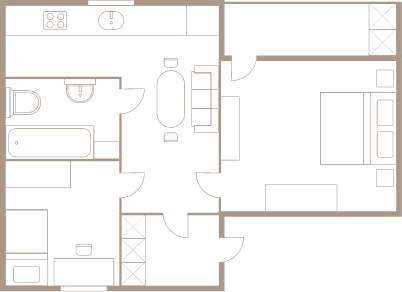

Available apartments

at q1-9 district

reviews

What people have to say

about q1 district

"Legere nominavi menandri ut usu, quodsi vis nibh accumsan. Nec magna per alterum veritus."

Ingrid Vulk

"Legere nominavi menandri ut usu, quodsi vis nibh accumsan. Nec magna per alterum veritus."

Kevin Wels

"Legere nominavi menandri ut usu, quodsi vis nibh accumsan. Nec magna per alterum veritus."

Simone Cooper

Make an appointment